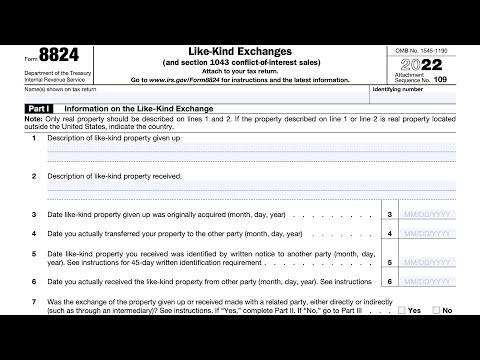

Will be going over IRS form 8824 like kind exchanges and section 1043 conflict of interest sales so most of the time taxpayers who would use this form would be involved in something called a section 1031 exchange section 1031 exchange is a part of the Internal Revenue code that allows taxpayers to defer the capital gain on the sale of Real Estate if as a part of that sale the proceeds are used to reinvest in a similar type of property so for example under 1031 this would be you know exchanging real estate you can defer the capital gain on the sale of an investment property such as let's say uh a duplex and you decide to invest that money into an apartment building since you're exchanging like kind properties you can do a like kind exchange which would defer your tax liability uh to at some point in the future when you sell the replacement property but then you also have to report the information on this on IRS form 8824 and that way you can keep a running tab on things like how much capital gains did you defer what's the adjusted basis in your new property did you actually realize or recognize any capital gains during the transaction and sometimes there can be uh you know a lot of complexity to what normally could look like a straightforward transaction so this form is designed to report most of that information and it also contains some things that not all taxpayer payers will will be using so that this is a two-page tax form with four parts uh part one most taxpayers will fill this out this is the information on the like kind Exchange part two uh related party exchange information so you would only...

PDF editing your way

Complete or edit your form 8824 instructions anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export how to fill out form 8824 directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your form 8824 pdf as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your irs form 8824 by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Form 8824

About Form 8824

Form 8824 is a tax form used by individuals or businesses to report like-kind exchanges of business or investment property. A like-kind exchange refers to the exchange of one property for another property of a similar nature or character, without recognizing any immediate gain or loss for tax purposes. The form is required by taxpayers who have participated in a like-kind exchange during the tax year and wish to postpone the recognition of any taxable gain until a later date. This form helps to calculate and report the realized gain or loss on the exchange, as well as to determine the basis of the property received. Individuals who have exchanged real estate, machinery, equipment, or other assets for like-kind property should use Form 8824 to report the transaction to the Internal Revenue Service (IRS). This form is important for taxpayers who want to take advantage of the tax-deferred benefits of a like-kind exchange and ensure compliance with the relevant tax regulations.

What Is Form 8824 Instructions?

Online solutions allow you to organize your document administration and boost the productiveness of your workflow. Follow the quick manual as a way to fill out Irs Form 8824 Instructions, keep away from errors and furnish it in a timely way:

How to fill out a filled in Form 8824?

-

On the website hosting the form, press Start Now and pass towards the editor.

-

Use the clues to complete the pertinent fields.

-

Include your personal data and contact details.

-

Make certain that you choose to enter appropriate data and numbers in correct fields.

-

Carefully check out the content of your document as well as grammar and spelling.

-

Refer to Help section if you have any concerns or address our Support staff.

-

Put an electronic signature on your Form 8824 Instructions printable using the support of Sign Tool.

-

Once document is completed, press Done.

-

Distribute the ready via email or fax, print it out or save on your gadget.

PDF editor enables you to make alterations on your Form 8824 Instructions Fill Online from any internet connected device, personalize it based on your needs, sign it electronically and distribute in different approaches.

What people say about us

How to fill out templates without mistakes

Video instructions and help with filling out and completing Form 8824